Portfolio

Cambrian Credit Union

Portfolio

Overview

About Cambrian Credit Union

Cambrian Credit Union is a Manitoban/local credit union offering regular banking, mortgages, investments, and loans. They are well-known and trusted among clients who like to support local and small businesses.

About

Project Summary

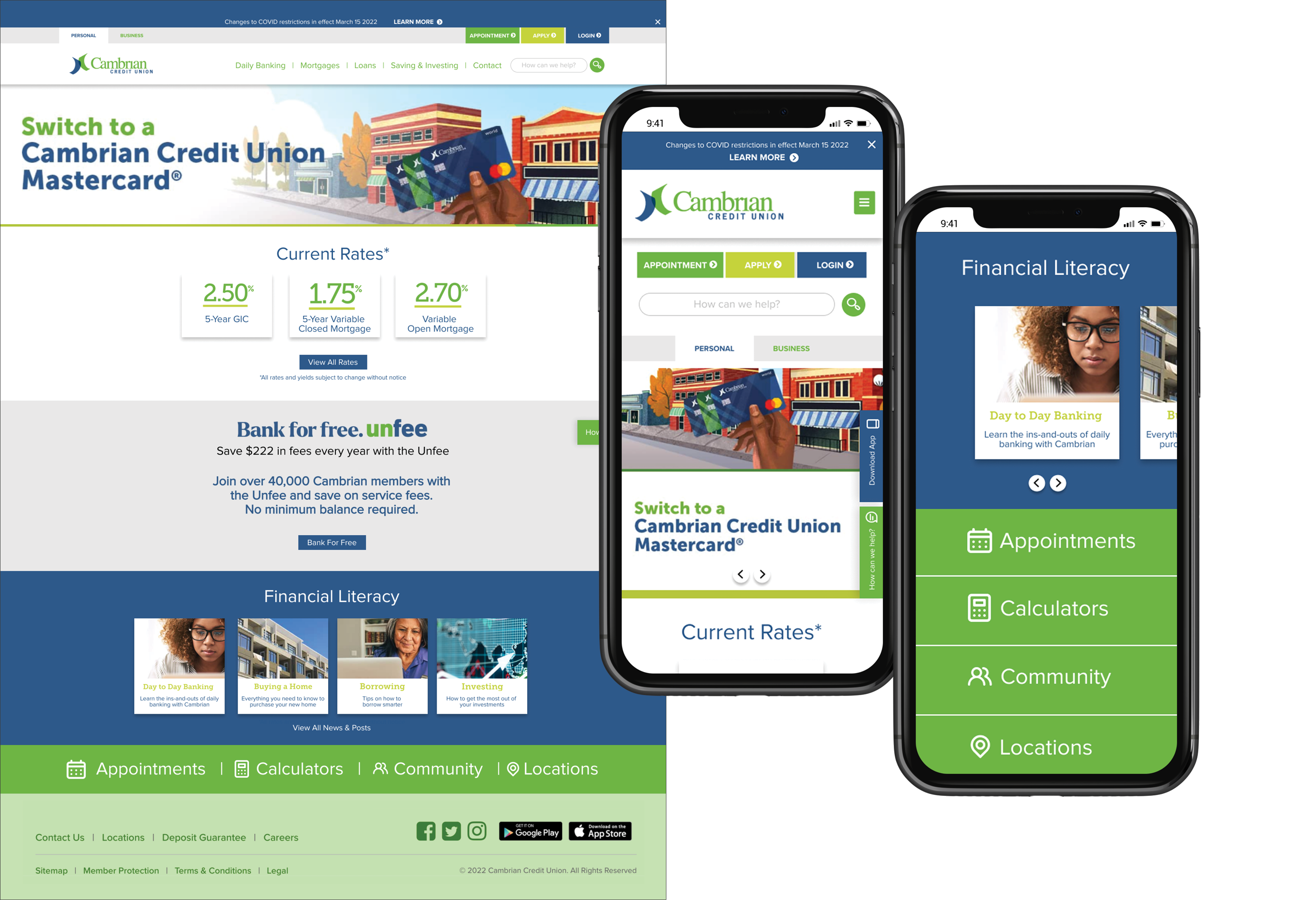

My goal was to do a preliminary UX & graphic design check of the current Cambrian Credit Union website and propose a functional redesign for desktop & mobile.

My approach began with a competitive analysis and pinpointing a target user story. I used this research to help define improvements that meet the needs of this user.

My involvement included ideating a user to design for, analyzing the website’s usability, creating high-fidelity designs, and presenting concepts and process notes to Cambrian business leaders.

Project Goals

The proposed outcomes of my redesign included:

- Helping boost new customer acquisition

- Promoting financial education

- Increasing customer retention

My Role

Roles & Responsibilities

Competitive Analysis | Graphic Design Analysis | UX/UI and Graphic Design | Design Pitching | Wireframing | Prototyping | High-Fidelity Designs

Tools Used

Figma | Adobe Photoshop | Adobe Illustrator

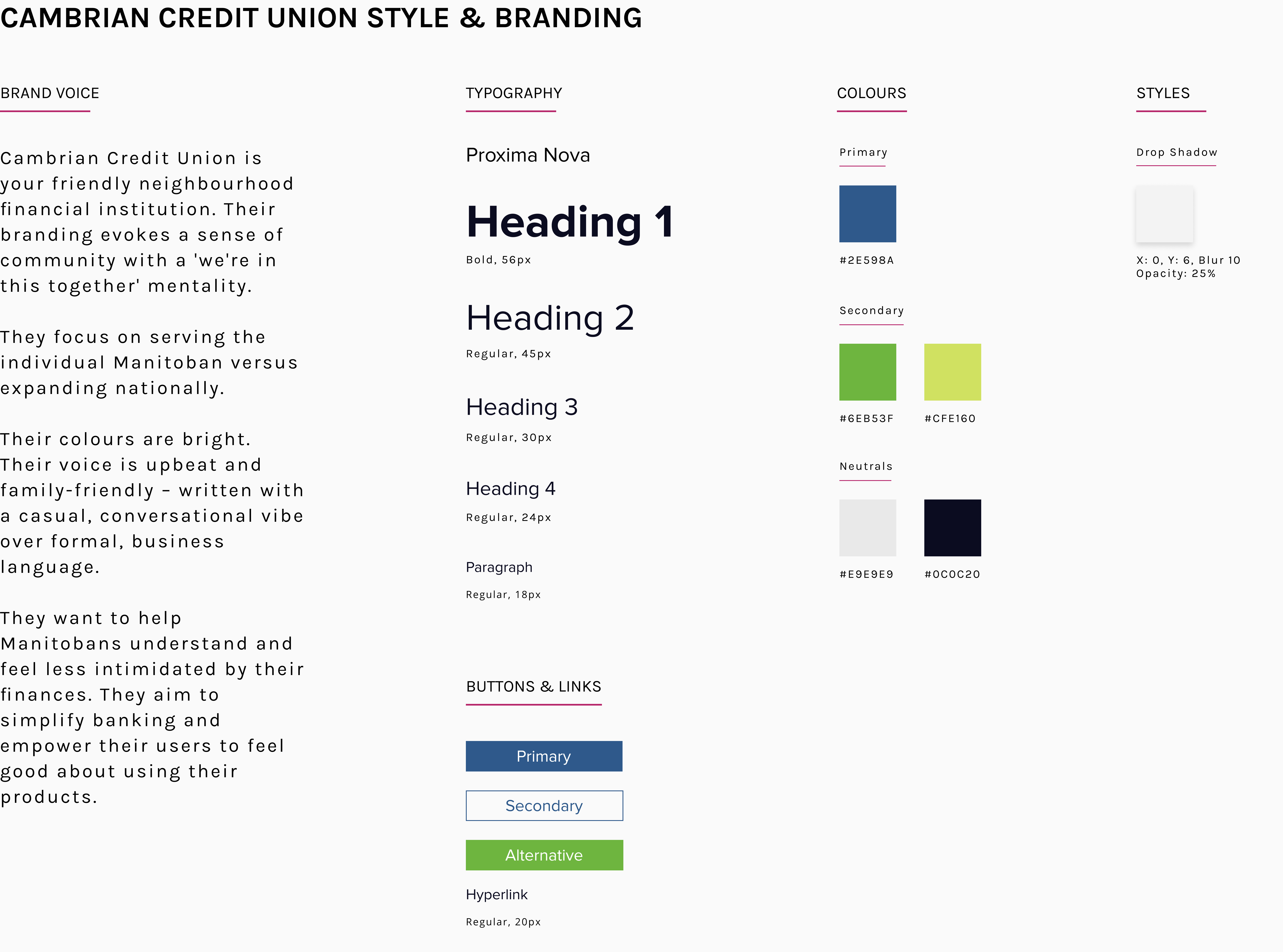

Brand & Style Guide

Research

Research Summary

Beginning with a competitive analysis and interview questions with senior leadership, I pinpointed Target Audience A - William, The First-Time House Hunter as the main user for this redesign.

Findings

Target Audience A

William, The First-Time House Hunter: A young professional living in a small city, William’s goal is to compare mortgage rates. He checks multiple banking sites two to three times a week to monitor any significant drops. He values a clear and concise interface with information that is easy to find.

User Story

As a young professional hopeful in becoming a first-time home buyer, William wants to be able to follow and view the most up-to-date mortgage rates so he can monitor and quickly apply for the lowest rate as soon as it becomes available.

User Behaviours

Motivations

• Is motivated by the lowest rate and is not loyal to a specific financial institution

• Wants an easy-to-use website where rates are easily-viewed

User Pains

• Searching through multiple page levels to find rates

• Not being able to find contact information or appointment booking easily

• Finding up-to-date literature on the current state of the market or advice on steps to purchasing his first home

User Goals

• Seeing and applying for the lowest mortgage rate among national and local banks

• Applying online or booking an appointment to apply in-person

• Staying up-to-date with what’s happening within the Canadian economy

"I'm excited to embark on my home-buying journey – I just wish banking websites would make it easier to find mortgage rates"

- William, The First Time Home-Buyer

Competitive Analysis

My competitive analysis included analyzing two direct competitors – a national and a local – and one indirect competitor. These were other financial establishments that William would likely also be using to monitor mortgage rates.

Competitor 1

TD Canada Trust

Direct Competitor

TD Canada Trust is a national bank that offers regular banking, mortgages, loans and investments. They’re perceived as a trustworthy brand as they have been around for decades.

Strengths

• National/well-known brand

• Offers other financial options aside from mortgages

• A standard bank; some may be hesitant to use credit unions

• Homepage includes links to helpful financial tips

Weaknesses

• Homepage has a lot of different options; could be confusing to new users

• Have to scroll far down/hunt for link to see mortgage rates

• Rates page is not easy to find on mobile; three-levels in

Competitor 2

Assiniboine Credit Union

Direct Competitor

Assiniboine Credit Union is a Manitoba (local) credit union similar to Cambrian. They offer a wide-array of banking services like regular accounts, investments, mortgages and loans. They attract clientele that like and trust smaller businesses and local branches over national brands.

Strengths

• Well-known among Manitobans

• Offers other financial options aside from mortgages

• Mortgage rates are easily viewed from the homepage and organized to see the information quickly

• Smaller business and locally operated

• Website has a chatbot for easy customer help

Weaknesses

• Homepage is cluttered with articles; with long summaries that take up a lot of real estate

• On mobile, you have to scroll far down to see mortgage rates

• Rates table is not responsive/mobile-friendly

Competitor 3

Castle Mortgage Group

Indirect Competitor

Castle Mortgage Group is a Manitoban/local mortgage broker. Their services include providing financial advice and guidance to get clients ready for first-time home buying, and finding and securing the best rate possible. They take on the work of monitoring and applying for the mortgages on behalf of their clients.

Strengths

• Option for people who don’t have the time to monitor rates on their own

• Appealing for first-time home buyers that might find mortgage-hunting intimidating

• ‘Find a Broker’, ‘Rates’ & ‘Apply Online’ CTAs are prominent on their website

• Website includes a lot of literature on home buying tips and explanations of financial terms

• Smaller business and locally operated

Weaknesses

• A lot of copy on their website; might become too exhaustive to find what you’re looking for

• On mobile, ‘Rates’ CTA is hidden under mobile menu

• Paragraph text throughout is small & hard to read on mobile

Design

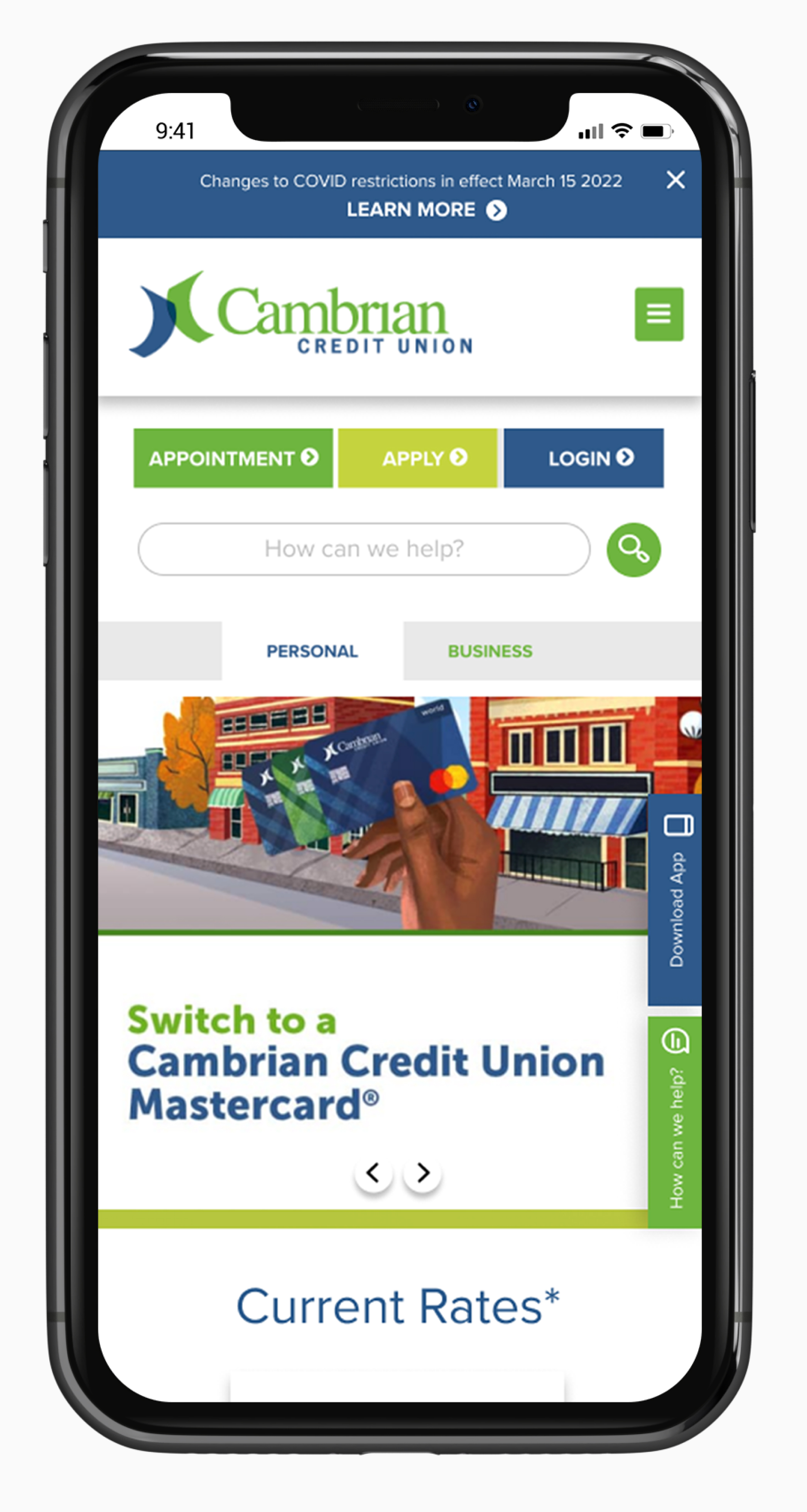

Design Thinking Summary

The proposed design aimed to address William’s pain points with the current Cambrian Credit Union website:

- Having to search through multiple pages to find daily mortgage rates

- Scrolling or going through the menu to find where to book an appointment online

- Searching through multiple page layers to find new information on the Canadian economy and advice on setting himself up for success in home-buying

The proposed design also aimed at boosting customer retention by including opportunities for personalized content based on user's interests and needs.

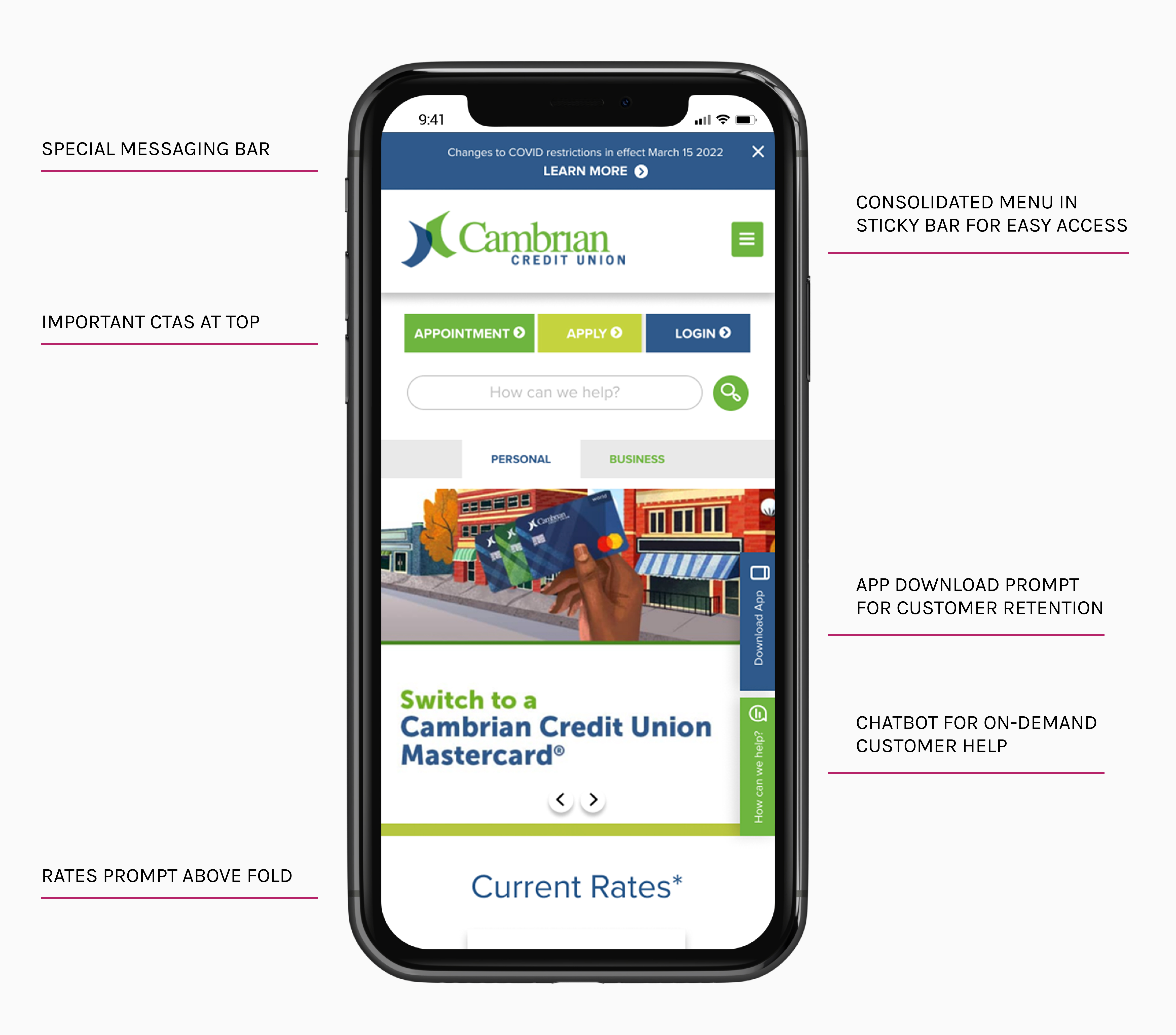

UX/UI Changes

Problem Statement

William is a young professional looking to buy his first home, who wants to easily view and monitor mortgage rates on a daily basis. He’s open to applying with Cambrian but currently it’s not easy to find Cambrian’s rates on their banking website.

UX/UI Improvements

- Mortgage rates callout available above the fold

- 'Appointment Booking', 'Online Applications' and 'Login' CTAs at the top for quicker access

- Addition of special messaging bar at top; to ensure the most important information is seen

- Chatbot functionality for users that need on-demand help

- Menu available in sticky bar for quick and constant access

- Homepage hierarchy organized based on user needs to create a personalization opportunity

Business needs

Improvements to Attain Business Goals

- Information Hub: Easily allow users to find and compare up-to-date interest and banking rates.

- New Customer Acquisition: Address the rise in potential new users and make the sign-up process quick and easy to find.

- User Retention: Creation of financial literature section to keep users informed and empowered about their earnings to build loyalty.

- User Retention: Site-wide prompts to download the Cambrian Credit Union mobile app to ensure customer data collection and serve relevant & personalized content.

Conclusion

Final Thoughts

By analyzing the Cambrian Credit Union website on desktop & mobile as well as other competitors, I pinpointed several points for improvement. Upon further research, I defined a clear target user for the brand – William, The First-Time Home-Buyer. Putting myself in William's shoes, I created this small homepage redesign to address his needs and create an overall experience that can better serve this subset of customers.